HOMEOWNER INSURANCE

Best Hassle Free homeowner Insurance For you

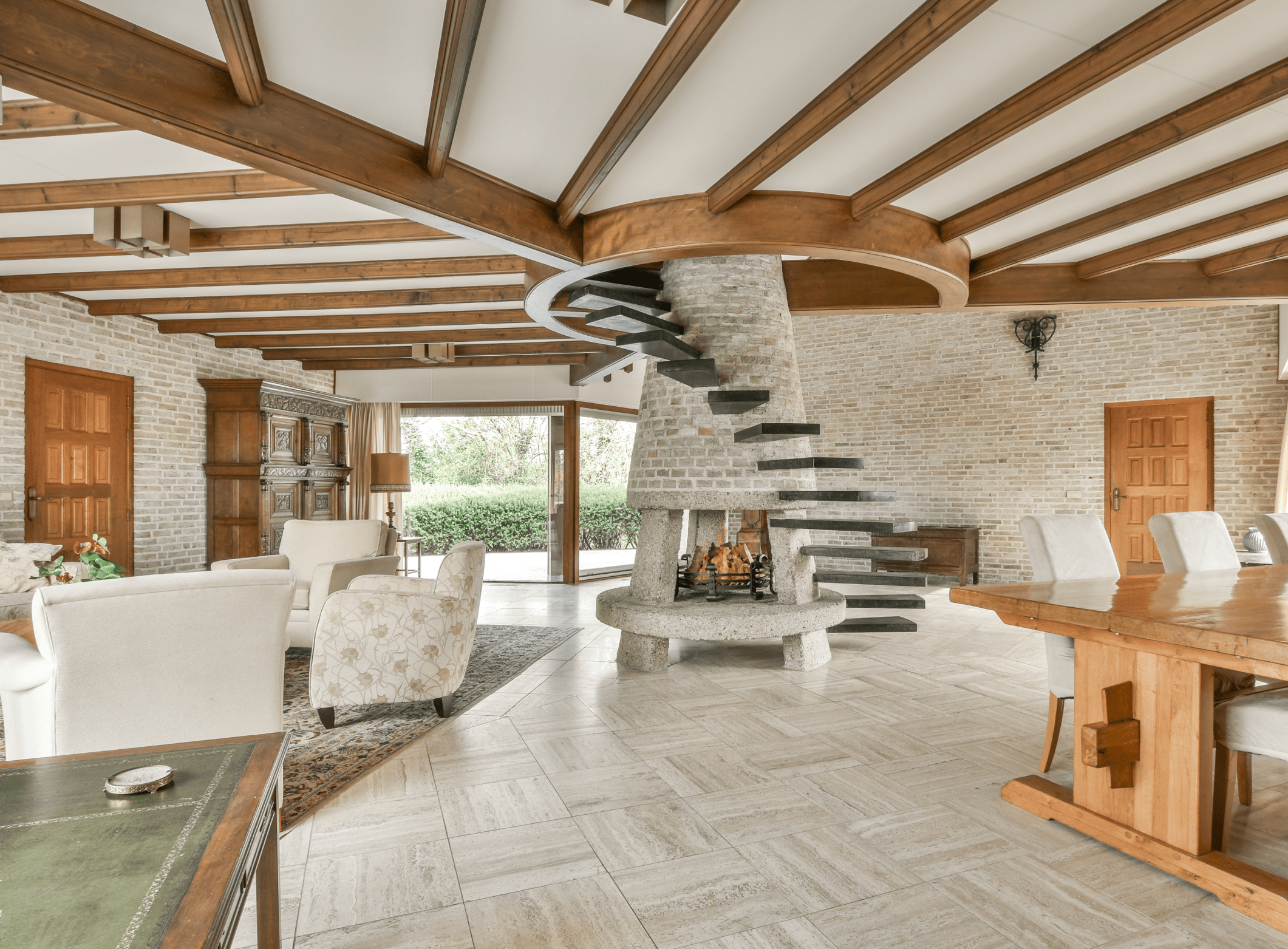

HOMEOWNERS INSURANCE FOR HIGH VALUE HOMES

Securing high-value home insurance can be a significant challenges, especially when seeking comprehensive coverage at a reasonable cost. However, you can trust Signature Insurance to offer the support you require, but it should be a value of £50,000.

We carefully designed home insurance to deliver comprehensive coverage, guaranteeing the protection of your property in unforeseen circumstances. Our expertise lies in pinpointing exceptional deals, providing top-tier coverage at competitive rates that align with your financial expectations.

KEY FEATURES AND BENEFITS

- Inclusive coverage beyond standard policies.

- Specialised insurance for historical or architectural properties and listed buildings.

- Ensuring complete protection against a variety of potential risks.

Higher payout limits for individual items. - Access to expert advice and services.

Smooth claims process and 24/7 assistance for emergencies. - Protection for 6+ bedrooms, Estates, luxury, and manor houses.

BEST HIGH VALUE HOME INSURANCE POLICY FOR YOUR NEEDS

High net worth home insurance steps where standard policies fall short safeguard your luxurious home and its valuable contents. It goes beyond what regular home insurance covers. Let’s take a look at what’s typically covered and what might not be, along with some optional coverage choices:

COVER

Protection of personal belongings against theft, loss, or damage.

Insuring valuable items separately (art, jewellery, antiques).

Coverage for items on the go or during travel.

NOT-COVER

Exclusions like normal wear and tear.

Certain damages not covered (war, deliberate acts).

Risks associated with unoccupied property.

Special items requiring extra coverage or separate policies

OPTIONAL COVER

Extra covers for items outside the home worldwide.

Coverage for household technology.

Insurance for homes under renovation.

Travel cover for trip issues and medical expenses.

Protection against legal costs.

Assistance for home emergencies.

Accidental damage coverage.

HIGH VALUE HOUSE INSURANCE COST

These prestigious homes are out of the ordinary regarding insurance, so our policies are custom-made for you. Our team knows their stuff when it comes to these unique situations. Our high value home insurance brokers are your go-to when you’re after a quote.

They’ll craft a policy that fits you like a glove and give you a precise cost.Remember, it’s essential to consider how much coverage you need and any extras you want. These things can affect what you pay for your insurance.

CHOOSE HIGH NET WORTH HOME FROM SIGNATURE INSURANCE

Specialist Support at Your Fingertips

Feel Secure Worldwide

Exemplary Art Expertise

GET LUXURY HOME INSURANCE QUOTE

For faster and more affordable rates, click the button below during office hours. We’ll ring you back instantly, whether right now or at a time that suits you, delivering an instant quote for prestigious home insurance. When you request a quote, it’s not just a number to us – it’s an opportunity for our specialists to assess the risk specific to your situation carefully.

Our sales team isn’t just about selling; they’re genuine insurance experts. We specialize in crafting bespoke insurance plans for your valuable assets.

CONTACT US TODAY FOR A FREE CONSULTATION

Protect your homes with our homeowner insurance. Get complete protection and peace of mind. Get a personalised quote today!

Homeowners Insurance FAQs

Find answers to commonly asked questions about homeowners insurance.

What is homeowners insurance?

Homeowners insurance provides protection for your home and belongings in case of damage, theft, or liability. It covers repair costs, personal property, and legal liabilities.

What does homeowners insurance cover?

It typically covers damages to property and personal belongings. It also provides liability protection in case someone is injured on your property.

How much homeowners' insurance do I need?

It depends on the value of your home, your personal belongings, and the cost of repairing or rebuilding them.

How can I lower my homeowners insurance premium?

You can reduce your insurance cost by installing security systems, maintaining security and maintenance checks, and bundling policies to meet your unique needs.

Why choose Signature Insure for homeowners insurance?

We offer customised insurance policies, competitive rates, and exceptional customer service. Our insurance policies are tailored to meet your unique requirements and offer you peace of mind.